Digital payment methods have increased in popularity over the past decade due to their convenience for both consumers and retailers. As the future of payments unfolds, it is important to stay educated on best digital practices. There are some basic concepts that will help even regular users of digital payments stay ahead of the curve and become more financially conscious consumers.

What are digital payments?

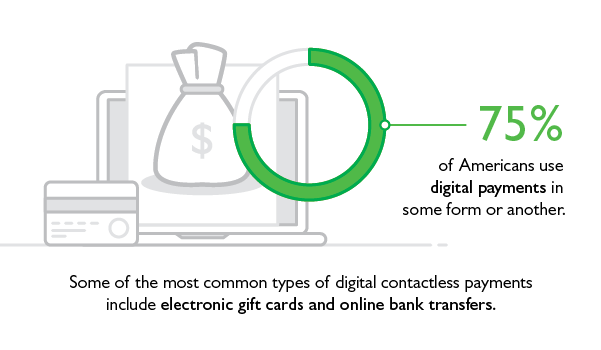

You may have been using digital payment methods without even thinking about it, as they have become so common in our society. At its core, a digital payment is a transaction or financial transfer that takes place without the use of physical cash. Three-fourths of Americans use digital payments in some form or another. Some of the most common types of digital contactless payments include bill pay, electronic gift cards, mobile banking and online bank transfers.

Digital payments are becoming more popular because the needs of financial service users are getting more complex and need to be automated. Sometimes called mobile payments, transactions done electronically create efficiency in the buying process. Think about digitized payment forms that you may have used before, such as PayPal, Venmo, and Apple Pay. When you send a friend money for dinner using Venmo, that’s a digital payment, as is using your phone to pay for groceries with a tap.

Benefits of digital payments

The process that might seem like it takes a few seconds relies on highly automated services from multiple companies, depending on your chosen digital method. Thanks to this technology, consumers do not have to rely on cash to buy something. It also allows people to make long-distance purchases and investments. You can make digital payments at most physical stores and online retailers. Even small businesses take advantage of the digital option by using technologies like Square Payments. This expands the potential consumer base, seeing as how only 30% of Americans use cash payments.

Digital payments are more popular with younger, working Americans. According to a study by Chainstorage, 80% of consumers aged 25-35 are likely to use this method. However, even older generations use digital payments frequently. This is in part due to the convenience and efficiency of paying digitally. Retailers, distributors, and nearly every part of the supply chain benefit from digital transactions. Even outside of that, moving money around online can make investing and wealth management easier.

One of the major technological advances that has boosted digital payments is mobile wallets. A convenience that Bank Midwest customers have enjoyed for many years, a mobile wallet is a completely digital wallet that stores payment information, including credit/debit cards, coupons and gift cards. Users can keep the wallet as an app on their phone and use it to make purchases. Apple Pay is another prime example of this technology.

Drawbacks of mobile payments

One of the major concerns that many people have is with the security of their financial information when it comes to mobile payments. A breach of this trust could result in stolen money or leaked passwords. However, many companies are willing to refund the stolen money if the user can prove that they did not make those purchases or transfers. There are simple ways to track where your money is being spent if your payment method was stolen.

Security with digital payments is increasing as more people are choosing this option. One of the most common and effective security measures is called biometric technology. Only the people who match the predetermined biometric features can access the digital payment. For example, a user may have to scan their fingerprint or face in order to pay.

As always, it is important for you to evaluate whether digital payments are right for you. In a world that is catering towards this method, it may be more realistic to carefully consider the companies that you are trusting with your information. Be aware of any service fees that could be required and read reviews of the company’s user interface.

How to use digital payments in everyday life

Due to their nature, digital payments are usually simple and easy to use. One of the biggest reasons that they have grown in popularity is because of how convenient they are. Instead of carrying around wads of cash or having to stop at the bank frequently, you can use digitized payments wherever and whenever you want.

This method of payment has become something that many people use without a second thought, but if you have yet to join the world of digital payments, now is a great time to start. Americans are putting their debit cards into a digital wallet, more online and brick and mortar stores are allowing digital payments. Those who have money deposited into their checking account can use the contactless payment option to buy things, pay people and pay bills without having to make a withdrawal.

Log in online or download your bank’s mobile app so you can pay your bills whenever you need to. With Bank Midwest’s mobile app, you can send money to a person if you have their mobile phone or email address. Or, take a picture of an invoice to make a bill payment.

Even if you have been using a digital wallet or Venmo, there is a lot more to explore. Entire industries work together behind the scenes to make the simple swipe of a card possible. Massive investments are made every day without anyone seeing the physical money or both parties meeting face to face. The consumer ecosystem is increasingly reliant on digital and automated services to move money faster and more securely.

To learn more about digital payments and mobile wallets, reach out to a professional at Bank Midwest.