Every business is unique, but there’s one thing they all need: the right insurance policy.

Business insurance is the best way to protect your company against financial hardship after an event like a natural disaster, theft or even a lawsuit occurs.

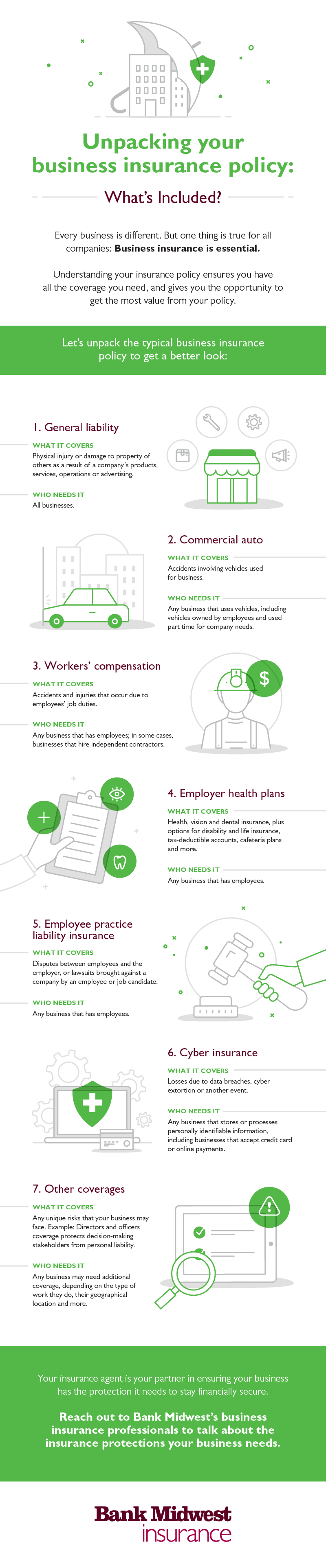

But it’s one thing to say business insurance is important, and another to fully understand what a policy fully entails. Insurance policies – even the basic business owner’s policy (BOP) – are complex products. If there is a typical policy, here’s a business insurance overview which would likely include the following types of coverages:

General liability

General liability is the one type of insurance that all businesses must have, regardless of their industry, size or whether they have employees.

This type of policy covers costs associated with injuries or damages caused by your business’ services or products, operations or advertising. Any business has the potential to harm another person or business, no matter how benign your products or services may be.

Here are a few situations in which general liability would likely apply:

- A defective product injures a customer.

- A shopper walks into your shop and trips over a loose carpet.

- A worker accidentally breaks a window in a client’s home.

- A customer files a lawsuit against you, claiming your advertising is false or misleading.

Doing damage control in any of these scenarios will cost money. General liability will help cover those expenses.

Commercial auto

Commercial auto insurance covers any accidents that occur due to work-related travel. This type of policy is not only for transportation-based businesses, like taxi services, heavy-duty truckers and landscapers, but for all companies that use vehicles in any capacity.

Consider these situations where a commercial auto insurance will cover accidental damages:

- An office manager uses their personal vehicle to transport items to an off-premise company event.

- An on-the-road salesperson travels to various locations in their personal vehicle to meet with clients.

- A restaurant offers delivery services, requiring employees to drive to people’s homes or offices.

Commercial auto is not included in the standard BOP, and must be purchased separately. Each policy is tailored to individual business’s needs, operations and fleet of vehicles.

Workers’ compensation

By law, you need workers’ comp if you have employees. In some cases, companies that hire independent contractors must also have this type of insurance policy.

Investing in a policy like this protects your employees’ livelihoods in the event they’re injured due to work-related activities. Workers’ comp will help cover medical expenses, and can reimburse employees for lost wages due to the injury.

Not only does this help keep employees financially healthy following an accident, but it also benefits their families, who would otherwise be short an income stream due to the injury.

Cyber insurance

Today, most businesses would benefit greatly from a cyber insurance policy. Cyber crime is a very real threat to any business, as hackers stand to gain much by attacking or infiltrating companies of any type or size.

Cyber insurance covers a wide range of costs that may be associated with a breach, including the cost to:

- Notify customers of the event.

- Repair or replace damaged computer systems or lost data.

- Respond to class action lawsuits.

- Pay fines issued by the state due to lack of protection of customer information.

Understanding your insurance needs

It’s not always clear to the average business owner exactly which types of insurance they need to sufficiently cover their liabilities.

Speaking with a business insurance professional at Bank Midwest can help you understand your risks and properly insure against them. To learn more, contact your local agent today.